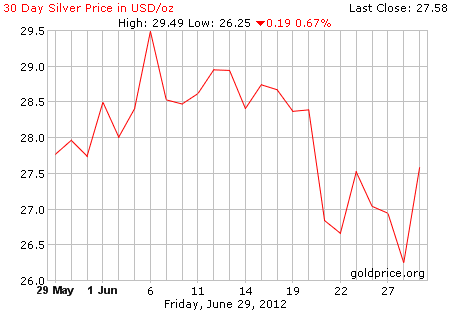

30 Day Silver Price

60 Day Silver Price

6 Month Silver Price

1 Year Silver Price

2 Year Silver Price

5 Year Silver Price

10 Year Silver Price

20 Year Silver Price

34 Year Silver Price

How the Price of Silver Fluctuates: What Sets the Price of Silver

Silver, gold and platinum are well-known precious metals. Physical silver is mostly traded in the London Bullion market where a bidding process sets the daily reference price called the fix. Silver paper contracts is mainly traded in the U.S. Commodity Exchange, Inc. (Comex), which is a futures and options exchange and also sets the spot prices. Silver can function as an investment, an industrial application, a financial hedge and a store of value. Due to the multiple uses of silver, the prices are determined by a large number of factors and players and are highly volatile. While silver prices are influenced by the fundamental demand and supply factors, large traders, investors and hedge funds can also move the prices.

Fundamental Supply and Demand for Silver

Fabrication demand, which includes industrial applications, jewelry, coins and photography, makes up about 85 percent of annual silver demand. Investment demand, government purchases and de-hedging make up the rest of silver demand. On the supply side, the production mines contribute 75 percent of the world supply of silver. In the last several years, the pace of increase in mine production has lagged the growth of fabrication demand, resulting in the rapid drawdown of existing stocks and a strengthening in silver prices. As silver is also a store of value, macro factors including economic growth, inflation, interest rates, currency depreciation and government debt levels will determine silver prices.

Large Traders and Investors Cornering and Shorting the Market

With a daily turnover of 18 times as big as silver, the gold market is much more liquid than the silver market. Global silver physical demand is also at about 11 percent of gold’s physical demand. In the 1970s, the Hunt brothers cornered the silver market and pushed the silver price to a high of $50.35. Investment houses including J.P. Morgan currently hold more than 90 percent of the silver’s short positions, making silver highly vulnerable to manipulation by one large trader or investor.

Financial Hedges

Like gold, silver can be used as a hedge against inflation, deflation or currency debasement. As major governments engage in stimulus measures to revive their economies, quantitative easing and deficit spending have led to currency devaluation and a fear of rising inflation, leading to a higher gold and silver demand.

Technical Factors Influencing Silver Prices

Silver prices are highly influenced not only by the strength of gold prices but also by the seasonality of gold. Silver supply is 18 times as plentiful as gold supply, so, theoretically, the price of silver should be one-eighteenth of the price of gold. At a current price of $1,582, gold prices trade at a ratio of about 54:1 to silver prices, making silver look relatively cheap. Given the much smaller liquidity in silver than gold, silver is likely to be a highly manipulated market, rendering technical analysis less useful in predicting silver prices.